Irfan Amin Patwary

Jahangirnagar University, Bangladesh

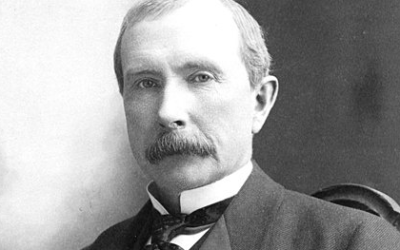

How does a six-year-old child of a middle-class family spend his days? There aren’t many exceptions except eating food handed to you by your mother, starting school for the first time, or playing sports with your friends. But if you were told that a 6-year-old boy bought 6 bottles of Coca-Cola at his grandfather’s shop for 25 cents, sold them to his friends for 5 cents each, and made a profit of 5 cents, would you believe it? A 6-year-old child did the same thing more than 85 years ago. He is currently one of the richest men in the world and possibly the greatest investor of all time. His name is Warren Edward Buffett, better known as Warren Buffett.

Warren Buffett was born on August 30, 1930, in Omaha, Nebraska, USA. Father Howard Buffett used to trade shares. Mother’s name was Leila Buffett. When Buffett was born, the stock market crashed and America suffered a severe economic crisis. The bank where his father worked and kept the family’s savings closed due to the recession before his first birthday. His father also lost his job due to the closure of the bank. They have fallen into a deep financial crisis for several years. His mother was sometimes seen not eating dinner so that his father could eat properly.

Seeing the plight of the family, Buffett understood the importance of having money in life from an early age. It gives him the ambition to become rich. When he was 13, he told a friend that if he wasn’t a millionaire by the time he was 30, he would kill himself by jumping off the roof of Omaha’s tallest building. However, he said about the money, “It is not that I want money.” I enjoy the process of making money and watching it grow”.

The idea of investing was in his blood. His mother was very good at mathematics. Warren Buffett also became famous for getting big calculations right from a young age. When he worked in his grandfather’s shop, he learned honesty, discipline, good manners. Also learned some tricks of retailing. He used to stand on the road with his friends and watch cars go by. The other children just watched the comings and goings. But he is not like others! So the license numbers of the cars that went were kept in the ledger. After watching all day, in the evening, he would compare which color license plates are the most.

When he was 9 years old, he and his friends would collect the cans from under the soda machine to see which brand of drink had the most cans. As his father was a stockbroker, he read his books about the stock market in his childhood. Read some books more than once. This gives him an idea about the stock market. At the age of 11, he went to the New York Stock Exchange and bought six shares of City Services. Three are his and three are his elder sisters. The price per share was $38. It dropped to $27 shortly after they bought it. Later, when it rose to $40, he quickly sold the shares. He later regretted it. Because the share price later became $200. In this, he learned to be patient and far-sighted. In this way, he learned business accounting and entrepreneurship from his childhood.

Their family’s fortunes finally turned when the wheels of the American economy were set in motion during World War II. In 1942, his father was elected as a congressman from the Republican Party. Then they moved to Washington. There he attended Woodrow Wilson High School. He didn’t care much for school. At this time, he read the book ‘One Thousand Ways to Make One Thousand Dollars’ by FC Minekar, which inspired him a lot. He then took a job as a reporter for the Washington Post newspaper in his area. He earned $175 a month.

Arriving in Omaha, he bought 40 acres of land for $1,200 and rented it out. He then enrolled in the Wharton School of Finance and Commerce in Pennsylvania. But he wouldn’t like it either. It turned out that he already knew what was being taught here. Rather, he knows more than the teachers. So he left there after only 2 years. He later moved to the University of Nebraska. He completed his graduation in just three years from there. By then his savings stood at $9,800. He then applied to Harvard Business School. But was rejected from there. And this turns his life around.

He read some books by famous investors Benjamin Graham and David Dodd. He has been their fan ever since. When he saw that they were professors at Columbia Business School, he applied there and was admitted to the Master’s in Economics. Anyone who has read the book ‘The Intelligent Investor’ knows Benjamin Graham. He is the author of that book.

Warren Buffett paid for his education by renting his land in Omaha at that time. During this time he had a good relationship with Graham. He quickly became Graham’s favorite student. Graham was then the chairman of an insurance company called Geico. Meanwhile, Warren Buffett was the only student in one of Graham’s classes to get an A+. During this time he also learned to give speeches from the Carnegie Institute. But after graduation, both Graham and his father forbade him from working on Wall Street. He then asked Graham to work with him for free. But Graham turned him down because Buffett was a Jew. It hurts him a lot. He then returned to Omaha.

He came to Omaha and got a job in his father’s shared office. Then he met a young woman named Susan Thompson. Once they fell in love. They married in April 1952. Then they rented a three-room flat for $65 a month. During this time he invested in Texaco Station and some real estate business. But none succeeded. At the time, Buffett was taking night classes at the University of Omaha. At that time, one day he got a call from Ben Graham. Graham invited Buffett to work with him. Young Warren Buffett’s dream finally came true. Joined there at a salary of $12,000 a year.

Warren Buffett and Susan then moved to New York. Buffett was then tasked with finding areas for companies to invest in. During this time his savings went from $9,800 to $140,000. In 1956, Graham retired and left their business partnership. Then Buffett went back to Omaha. He then thought he would retire at the age of 26. Then he remembered his childhood dream of becoming a millionaire. He thought it was possible for him to become a bigger man. Then they formed ‘Buffett Associates Limited’ with seven family members and friends for $1,05,000. Buffett’s investment was only $100.

Buffett had a family of five with his wife and three children. He then bought a five-bedroom house for $31,500. From the bedroom of this house, he used to do all the business work. Later took an office. He then applied the lessons he learned from Graham. Look for companies to invest in that are not in great shape, but their share prices are lower than they should be. He gained 251% over the next five years. Finally, he officially became a millionaire in 1962 at the age of 32, though not quite at 30.

In 1962, a gentleman named Charlie Munger moved from California to his hometown of Omaha. He was so brilliant that he entered Harvard Law School without a bachelor’s degree. Warren Buffett and Charlie Munger met through a friend. Their friendship eventually led to a business partnership. At this time they founded a company, whose name was ‘Berkshire Hathaway’.

Berkshire Hathaway was a textile manufacturing company. Founded in 1839, the company was in such bad shape for a decade that 9 out of 11 factories were closed. Its share price is $7, which should have been at least $11. Buffett then bought shares in this company hoping for quick profits. Then Berkshire CEO Seabury Stanton used the company’s earnings to immediately buy shares from investors. Had talks with Warren Buffett, and will buy from him for $11.50. But later it turned out he wanted to buy at $11.37 and tried to trick Buffett into 13 cents a share. Buffett had no interest in the company. But seeing the CEO’s deception, he started buying more shares. When he owns the majority of the shares, he is kicked out of the company.

Warren Buffett then began using the company as a vehicle to buy shares. Then he changed his investment style. Then he started buying big companies at fair prices. Started in 1964 with American Express Company. From 1967 he started buying insurance companies. National Indemnity, Central States Indemnity, and Geico – bought these insurance companies. Insurance companies deposit money like banks. Here customers pay regularly but withdraw money only in the event of a major accident.

By buying these companies, Buffett got a source of billions of dollars to invest. He invested this money in big companies with caution and prudence. Among these companies are names like Apple, Walt Disney, Coca-Cola, General Motors, and Bank of America. In 1983 Berkshire Company was worth more than 1 billion dollars. Warren Buffett became a billionaire himself in 1986. Currently, Berkshire Hathaway is known as a very profitable company. Now his personal wealth is more than 135 billion US dollars. He is currently serving as CEO and Chairman of Berkshire Hathaway. His comments are taken very seriously when it comes to investment and markets. For this reason, he is also called the ‘Oracle of Omaha’.

Although he was successful in his professional life, his wife Susan left him in 1977 and started living separately. Although they never divorced. It breaks him mentally. Susan, however, kept in touch with him regularly and wished him well. Susan died of oral cancer in 2004.

Warren Buffett has not only earned billions upon billions of dollars but has also donated in proportion. In 1981, he and Munger started the Berkshire Charities. Here every shareholder used to spend a part of the money received from the company’s dividend for charity. Each of his three children has a charity. He helped there. In addition, he donated a large amount of money to the Bill and Melinda Gates Foundation. So far he has donated more than 35 billion dollars. He has announced that he will donate most of his wealth to charity.

Some interesting facts about Warren Buffett

> Warren Buffett has been working at the same desk for over 50 years. This desk was also used by his father.

> He still lives in the house he bought in Omaha in 1958.

> He does not use a smartphone regularly and has sent email only once in his life.

> He spends almost 12 hours a day reading books.

> He likes to eat fast food very much. Buy a burger from McDonald’s on his way to the office every day.

> Bill Gates is his best friend. They recommend books to each other, offer business advice and even go out together.

> He was diagnosed with prostate cancer in 2012. Later his treatment was successful.

> Although his father is a Republican, he helped Hillary Clinton campaign for the Democratic Party. In this regard, in the documentary “Becoming Warren Buffett” aired on HBO, he said that his first wife Susan contributed to changing his political views.

> He had a good understanding of investment from childhood but earned 99% of his wealth after the age of 50.

> In 2013 he earned around $37 million per day.

Source of Information

- https://entrepreneuronemedia.com/success-stories/success-story-of-warren-buffett-the-worlds-greatest-investor-and-ceo-of-berkshire-hathaway/

- https://instaread.co/insights/business-economics-finance/the-warren-buffett-philosophy-of-investment-book/ktvxrdtcyi

- https://www.indiatimes.com/worth/news/all-you-need-to-know-12-things-people-waste-money-on-615332.html

- https://www.encyclopedia.com/people/social-sciences-and-law/business-leaders/warren-edward-buffett

- https://money.cnn.com/magazines/fortune/fortune_archive/1988/04/11/70414/index.htm

- https://www.investopedia.com/articles/financial-theory/08/buffetts-road-to-riches.asp

- https://hbr.org/1996/01/what-i-learned-from-warren-buffett

- https://www.investopedia.com/terms/o/oracleofomaha.asp

- https://analyzingalpha.com/warren-buffett